Becoming a Chief Financial Officer (CFO) is often the ultimate executive goal for those who have made finance their career. The position offers challenges, variety, and opportunities for growth. A good income is frosting on the cake.

Begin with Education and Experience

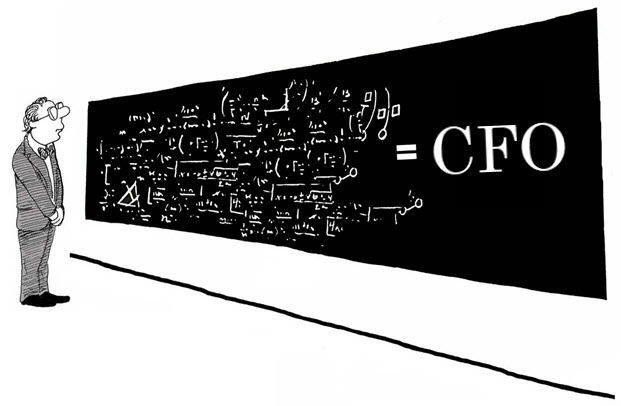

The steps to becoming a CFO are deceptively simple: get an education, preferably including an advanced degree; and obtain experience.

While not required, individuals with an advanced degree, such as a Master of Business Administration (MBA,) or those who have become licensed as a Certified Public Accountants (CPA) usually have the educational background to progress to CFOs. Other relevant degrees include accounting, economics, finance, public administration, and law. A good CFO never stops learning.

The focus of a CFO can vary significantly depending on the size and scope of the organization. Small to mid-market CFO’s will tend to have a very operations-oriented focus that augments the finance and accounting responsibilities that come with the role. Mid-market to large scale company CFO’s will generally have a more outward facing focus, concentrating on fundraising, capital needs, and strategic initiatives, and enjoy staff that can support the accounting and compliance responsibilities of the lead financial executive.

Regardless of the size of the business, the complexity and responsibilities of the CFO position require a comprehensive mixture of experiences. Some aspiring CFOs begin with entry-level positions in their preferred company or industry. Dependent on the size and industry, they may begin in the accounting department, or on the financial planning team. They learn the business from the bottom up and gain an understanding of how financial decisions impact every aspect of operations. They have usually held mid-level and senior management positions in more than one division of the company before advancing to the upper levels of financial management.

Others choose to gain experience by working in a variety of jobs for a variety of companies. They take positions as such as treasurers or finance managers, but they also gain experience in areas such as human relations and information technology. They may spend time as sales reps or work in service departments. Some work for government agencies or not-for-profit organizations to round out their experience.

Whether they learn in-house or elsewhere, in today’s business world, individuals who want to become CFOs must master technology. As early as 2016, analysis of a survey conducted by the accounting firm Ernst & Young (EY) emphasized the importance of digital know-how. CFOs “need to better understand digital technologies and data analytics.” In mid-market and larger organizations, contemporary CFOs must have an understanding of blockchain technology and how it affects their financial reporting. They also need to be aware of how using automated processes, including robotics, can reduce costs.

Network Instead of Going It Alone

The Association of Certified Chief Financial Officers (ACCFO) has set ethical and code-of-conduct standards for their CFO certification. They offer continuing education and networking opportunities to help members maintain their skills and advance in their careers.

Peer groups , like the CFO Alliance, or Financial Executives International (FEI) provide opportunities for members to connect with other members online and in-person. Members can discuss “strategy, people, technology, and risk” decision making in a confidential environment.

Fill Many Roles

CFOs are more than accountants, controllers, or managers. The popular colloquial reference suggests a CFO’s role is “walls out, and forward-looking,” meaning they concentrate on external relationships to the business, like CPA’s, banks, investors and shareholders. They also concentrate on where the business is heading. Contrast that with the compliance and reporting responsibilities generally held by an organizations Controller. Broadly stated, CFO’s duties have expanded exponentially beyond number crunching. As members of the executive suite, CFOs are decision-makers. Their in-depth understanding of their company and the overall industry enables them to lead the way to financial success. A CFO is a(n):

- Advisor

- Analyst

- Leader

- Mentor

- Planner

- Strategist

They use their skills to oversee financial operations, manage risk, and evaluate proposed expenditures and investments, all with a forward-looking view to the future.

Their job can include evaluating and managing areas such as:

- Capital structure

- Auditing and reporting

- Business planning

- Tax planning

- Capital expenditure

- R&D investment

- Working capital management

- Company budgeting

- Investor communication

They are also often responsible for ensuring that the company complies with the demands of dozens of regulatory authorities and agencies. They are also typically responsible for delivering performance reports and operational information to the Board of Directors and shareholders.

Continue to Increase Skills

That’s just a start. Due to the ever-increasing roles CFOs play in non-financial decision making, they are now referred to as Chief Future Officers in some circles. CFOs are expected to incorporate the following to their list of skills:

- Ability to collaborate company-wide and fill the role of partner to other members of the C-suite

- Ability to embrace and implement innovation, especially when it involves the digital transformation of the company

- Ability to manage talent and build teams

- Ability to adapt to changes and make decisions

Individuals who adhere to the traditional job description will potentially have decreasing opportunities for employment.

Perhaps the most essential characteristic of a contemporary CFO is the ability to communicate effectively. All the skills in the world won’t help if individuals can’t adequately express their ideas, plans, and decisions to others. Sites such as SkillsYouNeed have a wealth of tips for improving written and verbal communication. Entrepreneur also has a recent article on how to improve communication.

Get Involved

CFOs no longer sit behind a desk engrossed in numbers and reports, although analyzing financial data will always be part of what they do. Dictated by the size of the business, good CFOs are out of their office and in the trenches.

Most companies are only as good as their employees. Employees have certain expectations as to pay, benefits, and working conditions. Human Resources (HR) managers try to meet those expectations but often run into budget restrictions. A good CFO will work with HR to find ways to hire and retain employees in ways that achieve the company’s financial goals. Together they can put together salary and benefits packages that keep employees happy and contributing to the company’s bottom line.

Marketing is another area in which input from CFOs has increased in value. As with most other departments, the marketing division is hampered by budgets that are often arbitrary. Collaboration between the CFO and the Chief Marketing Officer (CMO) changes marketing from “a cost center to a revenue center.” CFOs can also use their knowledge of data analytics to provide the numbers CMOs need for creative marketing and advertising. That gives CMOs increased ability to increase the vital role of marketing in improving overall business profitability.

Hand-in-hand with collaboration between finance and marketing is the newer role of a CFO’s contribution to customer relations. They collaborate with the customer service and sales divisions to improve customer retention. Because CFOs have an overview of the business and comprehensive historical and current knowledge, they also have insight into the products and services that customers desire.

Go Beyond Knowledge

Education and years of experience provide the foundation of knowledge that is essential to succeed as a CFO. Individuals and their companies often believe that extensive knowledge is all that’s needed. For example, although he places importance on soft skills such as adaptability, one headhunter looks for “evidence of effective cost cutting, cash management, financial controls, and reporting and compliance.” That’s knowledge.

The exceptional CFO, however, progresses beyond knowledge to wisdom. Knowledge is understanding factual information. It’s a product of learning, doing, and thinking. Wisdom is using knowledge to make decisions and take action. It is based on intuition, relationships, and other intangible factors. Businesses today are run on technology and facts, rather than “gut feelings.” But there are times and circumstances in which an individual just “knows” when a decision or choice is right. Knowledge and wisdom are how CFOs lead their company to success.

An executive headhunter blogs that more than technical skills in finance are needed. His clients demand more than a CFO who knows the numbers. They want individuals who are leaders and adept at strategic thinking. He looks for experienced candidates who understand the numbers and who can use “Solomon-like wisdom” to make good decisions.

Our CFOs

We are extremely proud of our team of CFOs and controllers. They represent the best of the Northwest with decades of practical and professional experience in addition to extensive community involvement and legacy of volunteerism. We think you will also be impressed by their accomplishments. Meet our CFO team here >