Whether you are in retail, the supply chain, or are a manufacturer you have inventory. Ensuring that your inventory is “fresh” is a key to achieving profitability. Obsolete inventory can adversely impact your bottom line. Today we are discussing how to analyze the various inventory phases to eliminate or reduce your obsolete inventory.

What is Obsolete Inventory?

Obsolete inventory is a term that refers to inventory that is at the end of its product life cycle. This inventory has not been sold or used for a long period of time and is not expected to be sold in the future. This type of inventory has to be written down and can cause large losses for a company. Obsolete inventory is also referred to as dead inventory or excess inventory. - Investopedia.

One of the first steps in the analysis of inventory is for each company to define the critical terms used. Each company and industry have different dynamics that impact and define the following terms:

Term: - Definition

Slow Moving Inventory - More than six months on hand

Excess Inventory - More than 12 months on hand

Obsolete Inventory - No usage in last 12 months

Companies and industries with fast-moving, short shelf life products (ex: food) are very different from those with repair parts for long-lasting equipment (ex: aerospace parts). Inventory could become obsolete in three months to three or more years in the extremes, depending on the industry. Gaining awareness of your inventory movement, as well as checking with your Audit CPA’s is needed to settle on the acceptable definitions for your business.

Companies and industries with fast-moving, short shelf life products (ex: food) are very different from those with repair parts for long-lasting equipment (ex: aerospace parts). Inventory could become obsolete in three months to three or more years in the extremes, depending on the industry. Gaining awareness of your inventory movement, as well as checking with your Audit CPA’s is needed to settle on the acceptable definitions for your business.

The path from valid inventory to obsolete inventory usually passes through the phases of slow-moving, to excess, to obsolete for both raw materials and finished goods.

The key to managing inventory levels is to have visibility to inventory trends. Usage or sales trends are important indicators of potential inventory issues. The trends should be evaluated monthly or quarterly, depending upon your industry.

A few notes about inventory systems

The following analysis relies heavily on reporting from your inventory system. Standard reports are not always readily available, be prepared to have custom reports made for this analysis. More sophisticated inventory systems have several calculations to assist in managing inventory (re-order point, EOQ, etc.) but for smaller companies with less sophisticated systems, custom inventory reports will be needed.

The burden of file maintenance can be an obstacle in using advanced inventory calculations to keep inventory at the correct levels. The parameters used in advanced calculations need to be looked at frequently, as supply and demand changes quickly. A company reviewing inventory factors/parameters of thousands of SKU’s manually can be extremely cumbersome. In many cases, time restrictions can leave these system calculations incomplete and inaccurate.

Whatever system you rely on proper maintenance of data to ensure the validity of the analysis will be required.

Inventory analysis

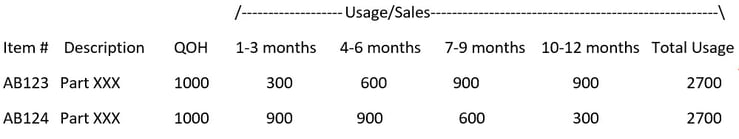

To identify slow-moving inventory, reports that compare quantity on hand (QOH) vs. usage/sales (which includes both production usage and sales) are required. Slow moving inventory reviews should be done religiously every month. It is important to catch issues as early as possible to avoid an excessive inventory categorization. An inventory report I have found useful looks like this:

As you can tell by these two examples, the total usage over 12 months is the same but the usage trend by quarter is much different and a better indicator of slow-moving inventory problems.

A typical calculation of Months on Hand (MOH) or Days on Hand (DOH) for Total Year Usage, indicates that both items are both at 4.4 months on hand (MOH).

However, using the trend report and looking at the last three months usage,

- Item AB123 MOH is at 10, while…

- Item AB124 MOH is at 3.3.

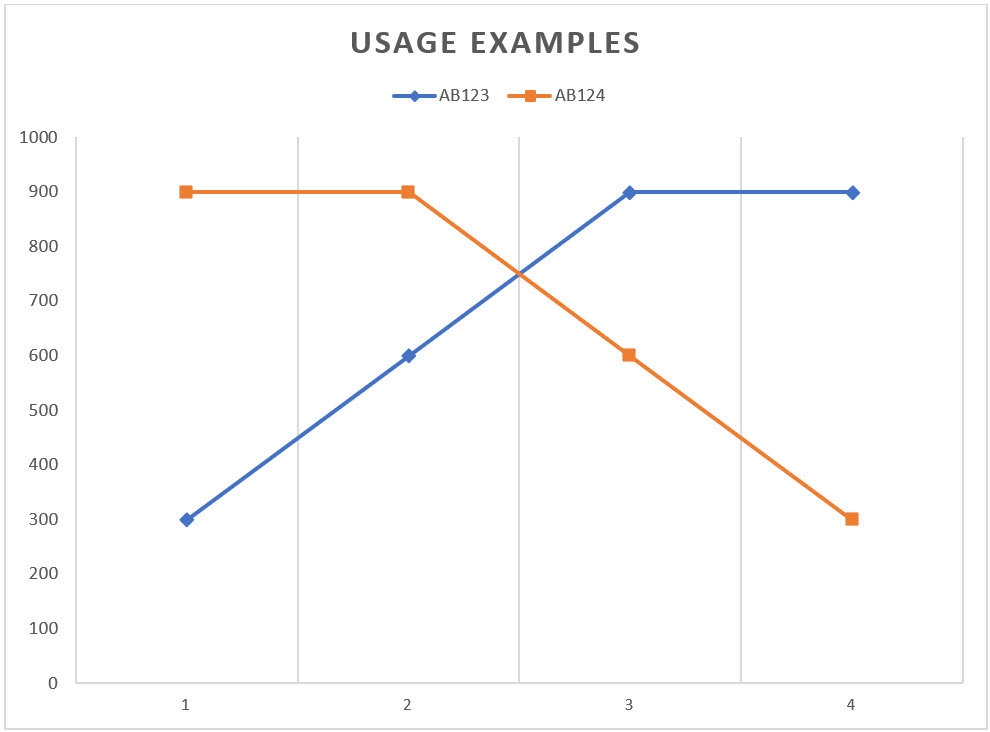

The 3-month calculation does not give a complete picture as the trend indicates usage in the last three months might be overstated. A visual of the trend is graphed below:

In the first example, the graph indicates a decreasing demand/usage and the “Months on Hand” at 10 months. A close watch on Item AB123 each month may determine an increase in inventory may create an excessive amount. Until there is a clear understanding of the market and production, it would make sense put further purchases on hold.

The second example of Item AB124, with the same Quarter on Hand (QOH) and total usage, tells a completely different story. “Months on Hand” is just over three months and usage/sales are increasing which gives a much different outlook.

A special note here:

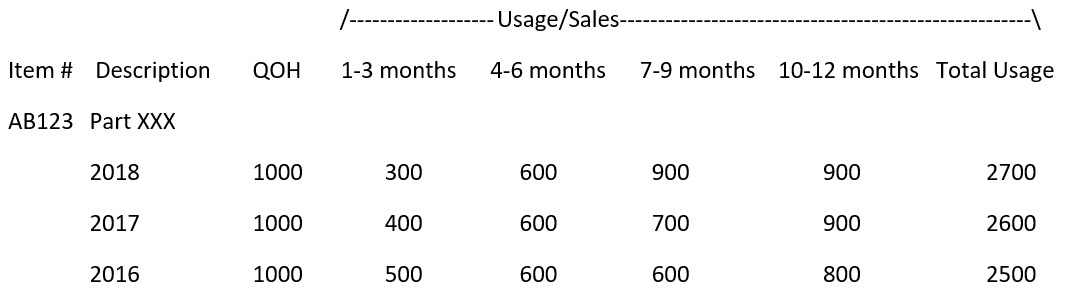

If your business is significantly seasonal, life will be much more complex. The above trends of quarterly usage/sales must be compared to previous years to determine if the usage trend is increasing or decreasing. You can accomplish this by extending the usage/sales by quarter like in the above example to include the previous year and if necessary, the year before that.

In the above example, trends indicate higher usage in 2018 (good news) but a lower usage in the latest three months (potentially bad news). Here again, the trend is what is important.

Regardless of seasonality, the analysis of the trend reports is the critical activity to identify slow-moving inventory, before it crosses the line and becomes hard-to-move excess inventory. Showing the usage/sales data in a graph will aid with the trend analysis.

Situations that cause usage trends to change quickly are at times self-generated. For instance, when new products are introduced, and previous versions are not phased out properly, a usage/sales trend line can immediately change without warning. Good communication between product development, sales, purchasing and inventory control, is essential.

Situations that cause usage trends to change quickly are at times self-generated. For instance, when new products are introduced, and previous versions are not phased out properly, a usage/sales trend line can immediately change without warning. Good communication between product development, sales, purchasing and inventory control, is essential.

Regular, frequent trend analysis of usage/sales is the main method of identifying potential slow-moving inventory and the reduction of excess inventory.

Excess inventory

If, for whatever reason, you have excess inventory, now is the time to respond. Responding quickly offers more options to reduce these inventory levels while there may still be some demand. Some of the options to get whatever remaining value there is before excess inventory becomes obsolete include:

- Price decreases

- Discounting

- Clearance sales

Once inventory becomes obsolete, your options for disposal become very limited so catching an inventory problem when it still has some value is very important.

There may be cases when you may decide to hang onto excess or even obsolete items.

- Will interest in the product come back?

- Is there a repair or warranty option?

For example, there are companies in the aerospace industry that do a good business by inventorying seldom used parts. These parts can sell at premium prices as only certified parts can be used on aircraft. Not all industries are so lucky. In each situation, look at the cost of retaining the excess or obsolete inventory. There are considerations such as tying up cash that could be used in more productive ways, the cost of warehousing, and the cost of managing the inventory, that should be included in your decision to keep or dispose of obsolete inventory.

Whatever your options to reduce inventory levels, the first step is to identify which items are potentially in excess and at risk of becoming problematic, whether raw materials or finished goods. Hopefully, this offers you a new method to identify inventory issues before they become a financial burden.

If you have other thoughts or experiences about obsolete inventory, please share with a comment below!

About the Author

Roger Johnson has more than 30 years of private and public company experience as CFO, VP of Finance, Controller, and Director of Finance and Administration. His industry background spans manufacturing, distribution, supply chain, and financial services industries. Roger has over 20 years of extensive international experience in Asia and Pacific Rim countries and was an expert Foreign Lecturer in the People's Republic of China for the Central Institute on Finance.

Roger received his accounting degree from the University of Illinois and an MBA from Pepperdine University.