Many businesses don’t need a CFO. Yours may be one of them.

To be clear, pretty much every business needs some form of finance lead, or at least a solid accountant.

But if you are the owner or CEO of a privately held, reasonably successful small to mid-sized business, it’s pretty unlikely you need a CFO. Certainly not a full-time CFO.

Now, depending on some of the challenges your business is facing, you may have the need or desire for some form of interim, part-time or “fractional” CFO. But a full-time permanent CFO? There’s a good chance that just doesn’t make sense.

Why not? Because in this type of business, the primary responsibilities of the true CFO are either not required or they are handled by the business owner or CEO.

Understanding Roles

In order to critically evaluate the need for a CFO, an understanding of the roles different management team members play may be helpful. For example, it has been said that -

- The primary role of the successful business CEO is to provide vision.

- The role of the executive team is to devise and execute strategy that supports the CEO’s vision.

- The company’s managers are responsible for ensuring compliance with controls, policies and procedures while introducing value-add business practices that improve effectiveness and efficiency.

In many smaller businesses – particularly those run by the founder - the responsibilities of vision and strategy both reside with the CEO or business owner.

In that case, if you are a business – particularly a profitable, successful business - under $50 million in revenue, you probably need a good Controller. But not a CFO.

Here's why.

Which is Which?

One approach to thinking about the need for a CFO is to address a question small-to mid-sized business owners often ask:

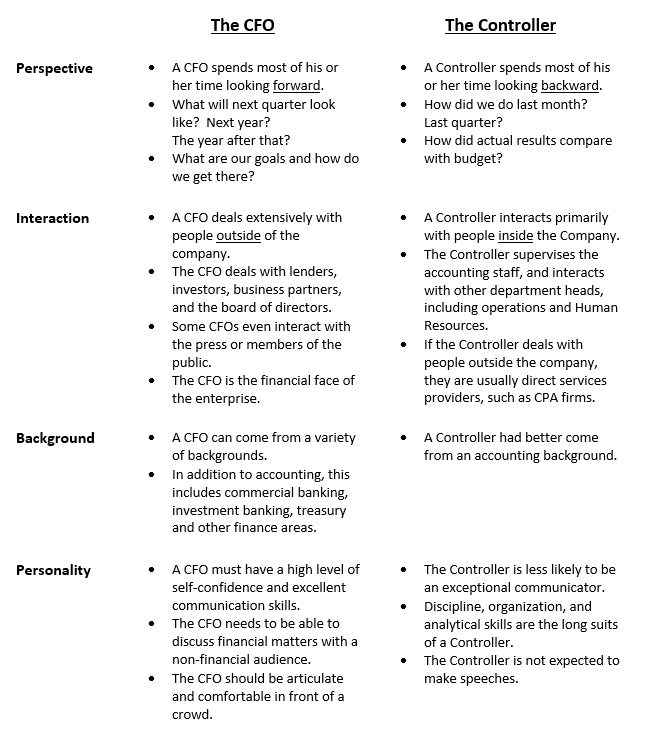

What’s the difference between a CFO and a Controller?”

Here’s one way to look at it:

By the Way…

When it comes to the CFO’s experience and training, an accounting background may be helpful. But maybe not. Accountants are trained to be conservative and risk averse. Many are often afraid to be wrong. That type of training isn’t all that conducive to forward-looking strategic thinking. The successful accounting-trained CFO is someone who, as the saying goes, “was a CPA but got over it.”

Who Has Both?

A number of smaller or middle market businesses have both a CFO and a Controller. Or at least they have staff members with those titles.

In many cases, the CFO is very involved in operations while the Controller handles the accounting. So, the CFO is really more of a COO. That’s because the CFO may have started out as a Controller, been promoted to CFO, hired a new Controller, and then moved into operations.

Good for him or her. But that’s not really a CFO.

Let’s Take It A Step Further

Some businesses may not even need a Controller, much less a CFO.

A privately-held, single owner, successful company with no debt probably has very limited external financial reporting requirements. No lender, no outside investors, and no board of directors, means that it is pretty much up to the business owner to decide what information he or she wants to see.

A basic profit and loss statement is usually helpful. Supplementing that with a simple summary of cash, receivables and payables may be all this business needs.

In that case, a competent, experienced Accounting Manager may be the right resource. This individual can make sure customers are invoiced, receivables are collected, and employees and suppliers are paid. If no one is asking for a full set of GAAP-format financial statements, you may not need a Controller.

But Things Can Change

It involves a phenomenon referred to as “OPM.” – Other People’s Money.

When it comes time for the business owner to exit the business or attract outside funding, the information needs usually ramp up. For example, lenders and investors want to see real financials. And they will want those financials to be audited or reviewed by a reputable CPA firm.

Investors in particular will also be looking for meaningful analysis of operating performance – also known as “Management Information.” And that includes a pretty comprehensive picture of what future performance will look like. So, a business looking for OPM that has never done financial planning and analysis may have some scrambling to do.

How About Someone Who is Both?

But what about the CEO or business owner who says, “I want some of both? I want an individual who can ensure compliance and accuracy but also function strategically.”

Ahhh, yes. The “Hybrid.” The person who is both CFO and Controller.

This individual goes by several names. “Finance Director” is one. “VP Finance” is another.

This position is hardly ever accompanied by a Controller. Because this position is the Controller.

This Finance Director or VP Finance prepares the financial statements, supervises the accounting staff provides information to the operations team, and deals with compliance matters in areas like insurance, benefits, taxes and state and local business compliance.

At the same time, this individual can deal effectively with banks and can support the CEO in interactions with potential investors or business partners.

While this position is not exactly a unicorn, it is pretty rare in the world of under of $50 million revenue companies. To the extent it exists, it is often because someone gradually grew into the role.

Hiring this type of VP Finance from outside the company can be tricky. That’s because individuals with a very strong accounting background along with high self-confidence and excellent communication skills usually gravitate to larger organizations.

This type of person is often looking for opportunities – both in terms of career growth and financial reward – that are difficult to find in a smaller business.

So, What Do You Need?

Wayne Gretzky has been quoted as saying,

Wayne Gretzky has been quoted as saying,

A good hockey player plays where the puck is. A great hockey player plays where the puck is going to be.”

Clearly the thought has business applications. One of them is determining what type of finance leader you need. Now and in the future.

Much depends upon how you feel about your business information and how comfortable you are using it to discuss where your business is going.

To paraphrase Gretzky, a good company knows where they are. A great company knows where they are going to be. And a poor company usually knows neither.

If you are entering into a business acquisition or divestiture, a major financing transaction or a corporate reorganization, the CFO skill set may be useful.

But even under those circumstances you may not need a permanent full-time CFO. A fractional CFO may do the trick.

Deciding what you do need involves a basic process:

- Understand the attributes and characteristics of each type of finance position

- Calibrate those characteristics with your business needs

- Anticipate changes to those needs in the future

- Select the position that best fits your needs and make sure you have the most competent individual in that role that you can afford

Whether you have a successful small to mid-sized business, an underperforming one, or are planning for a business transition you may have needs that require a part-time finance leader. If you decide you do need an interim or fractional CFO, Controller or Accounting Manager, you can contact us here.

If this article was helpful and you would like your own personal copy, a pdf version is available here.

About the Author

Dave Saporta has over 30 years of experience in a wide variety of business environments. He has served as CFO and Corporate Controller for large companies with international operations, as well as providing hands-on finance and accounting advisory skills to smaller, emerging businesses.