Running out of cash is not only a sign of poor planning, but it's also one of the biggest reasons that businesses fail. Forecasting your company's cash flow can be tricky because of the many variables that determine how much cash you will need for operations versus the amount available.

Cash Flow Forecasting Challenges

The underlying problem with cash flow forecasting is that it often doesn't provide the precision necessary to make sound business decisions. According to recent data from HighRadius, almost 90% of treasurers at large companies surveyed rate their cash flow forecasting accuracy as “unsatisfactory.”

Ask any CFO or treasury manager about this process, and they will tell you that the inaccuracies often stem from two areas: poor resources and lack of communication. Your output is only going to be as effective as your input. Business segments within an organization must also find more effective methods to communicate their forecasts, as well as their challenges.

Keys to Accurate Cash Flow Forecasting

While there is no "silver bullet" available to solve every company's cash flow forecasting roadblocks, having the right processes in place is a good start. What and how you measure something will vary depending on your business, industry, and goals. For example, a seasonal business that generates 80 percent of its sales over just two months of the year will have different cash flow needs than one whose revenue is steadier throughout the year.

So, how do you go about producing an accurate cash flow forecast? Here are five tips that will help your organization bring more precision to the process, which will increase your company’s chances of survival and provide you with the resources you need to grow.

- Establish Lines of Communication

The consequences of an inaccurate forecast can be severe. A company might borrow more than it needs to meet conditions that don't materialize. On the other hand, it could leave funds unnecessarily idle. The best way to avoid any type of liquidity crisis within your organization is to train top management in the importance of forecasting, as well as the mechanics of the process.

As with just about any other successful process within a company, communication is one of the keys to accurate cash flow forecasting. An effective forecast requires input from a variety of individuals throughout your organization who can provide important figures and valuable insights that will increase understanding of what drives the numbers. - Don’t Confuse Cash Flow with Revenue

Both revenue and cash flow are used as indicators to help investors or analysts evaluate the financial health of a company, but revenue provides a measure of effectiveness in sales and marketing, whereas cash flow is more of a liquidity or money management indicator.

Cash flow includes operational sales revenues and monetary sources beyond merely sales revenues. Companies often generate or obtain cash in a variety of ways that lie outside the conduct of their main business.

The critical importance of cash flow lies in the ability for a company to remain functional; it must always have sufficient cash to meet short-term financial obligations.

While sales revenue is only a measurement of a one-way inflow of money and no other type of transaction, cash flow is a measurement of cash that comes into a company in the form of sales as well as other methods. Therefore, unlike revenue, cash flow has the possibility of being a negative number or value.

- Identify Your Inflows and Outflows

For any CFO, much of this is elementary, but your cash flow forecast should be a detailed look at your company's cash position relative to its inflows and outflows. To start, how much money will you be bringing in over the period in question and from what sources? This isn't a measure of your company's capacity to produce products or services, but rather what will be collected in payment for goods and services.

Historical sales data is a good place to start, but this must take into account macroeconomic factors such as consumer confidence levels and even small business confidence if you rely on B2B sales. Obviously, sales won't always be consistent, so those communication channels you developed will give you valuable insight into other factors and business drivers that could impact these numbers.

Have any of the terms or relationships with vendors changed that could affect the speed or amount that you are paid for products or services? Your systems should be able to identify patterns in debtor remittance that allow for more accurate forecasting. Have you had recent price changes that will adjust your figures?

Your company may have a new product release scheduled which will affect sales or it could have had a product recall which is going to throw a wrench into your forecast figures. Consider what just happened with Hyundai and Kia – almost 170,000 of their EVs were recalled over a software problem.

When you forecast your outflows, you'll need to include both fixed and variable costs while making a distinction between the two. Obviously, your business will have some type of overhead which includes the salaries, rent, and utilities that you pay. While some of these expenses may increase in times of high-volume business, you should be able to predict them will a fair amount of accuracy.

Variable expenses will change along with your production and sales volume. This includes your cost of goods sold (COGS) as well as recurring variable expenses such as quarterly taxes, seasonal inventory, and months with an extra pay period.

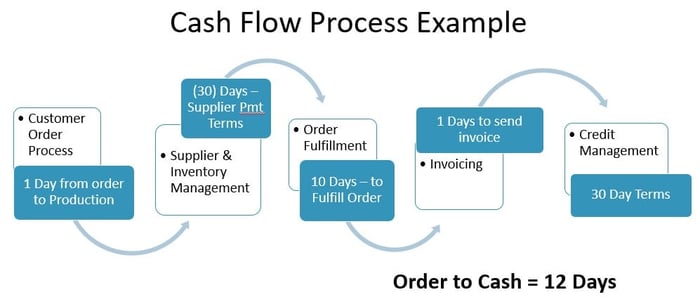

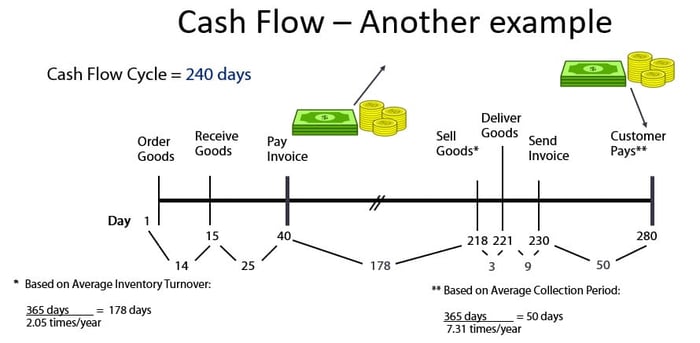

The timing of these payments is critical for an accurate forecast. Let's assume that your COGS is 60% and you plan to generate $100,000 in sales during the first quarter. You would need $60,000 worth of goods in inventory to cover those sales, but not all of that cash may be needed upfront. You will have to pay for labor immediately, but raw materials may be on credit terms of 90 days or more.

Your company should also accurately forecast for any one-time expenses that it foresees. These might include equipment purchases, employee training programs, and annual bonus payments. If in doubt about a potential expense, it's best to put it into your forecast as a safety.

4. Create Several Scenarios

When you produce a cash flow forecast, it may be helpful to create several different scenarios. Let's assume that you work in an industry where a potential tariff could undermine your future business. It hasn't happened yet, but it would be helpful to know what your cash situation is going to be should this occur. Two examples:

When you create multiple scenarios with your company's future cash flows, you will be able to visualize the impact of certain future conditions, as well as quickly adapt your company's processes when necessary. Provided you have automated your forecasting process, these scenarios should be simple enough to produce so that you won't have to scramble in a reactionary mode at a later date.

- Publish, Monitor, and Adjust Results

No cash flow forecast should be set in stone, since there may be customers who fail to pay, sales that don't materialize, or unexpected expenses that show up on your doorstep. Once you publish a forecast, continue to monitor results in real time as much as possible. Doing this will allow you to identify opportunities to improve your process and may permit you to take advantage of a better cash position on occasion.

Since few companies will hit their forecast on the mark, the measure of cash flow accuracy is one of degrees. As a company, decide what sort of variance is acceptable and aim to reach that goal. For example, you may be comfortable with a 5% variance overall but have different targets for certain categories.

Most organizations don't have the financial strength to survive even a short-term cash flow crisis, so having accurate forecasts on hand is essential. When you have these working reports available, you and your management team can monitor your company's results and adjust your plan as needed. Large and complex organizations should prepare a monthly forecast that extends a minimum of six months and preferably out to a year.

Cash flow forecasting may be an arduous task, but it is a vital one. This critical process will not only tell you how much cash your business is expected to generate but also what it is going to need to fund future expansion and working capital. While your forecasts will never be 100% accurate, you will develop an uncanny ability to predict the future if you devote the proper resources to cash flow forecasting sooner rather than later.

We have a team of consulting CFOs who can help you with cash flow projections. We would be happy to schedule a complimentary consultation to discuss your needs and business challenges at your convenience. Contact us today to find out more!

Originally published: 4/20/2018

Updated: 8/8/2024

About the Author

Kevin Briscoe is the Managing Partner of CFO Selections®. He stewards the culture and core values of the organization, including supporting the firm's philanthropic work through the CFOS Foundation.

Kevin Briscoe is the Managing Partner of CFO Selections®. He stewards the culture and core values of the organization, including supporting the firm's philanthropic work through the CFOS Foundation.

Throughout his career, Kevin has held ownership and management positions, providing effective leadership in increasing profitable growth. His professional career includes over 30 years in finance, accounting, and operations from Fortune 100, publicly traded corporations to small, closely held settings. Before joining CFO Selections® in 2007, Kevin was part owner of a successful lighting representative business, helping drive their growth from $30 to $70 million. He has also served as a financial member of South End Equities, where he was responsible for the purchase and management of a commercial real estate portfolio. His extensive experience in business strategy, management, and operations assists him in leading the firm.

Kevin earned a Bachelor of Business Administration degree in accounting from Gonzaga University.

He currently serves as Board Member for The Behavioral Tech Institute and has served as a past Board member of the Electric League of the Pacific Northwest Charitable Foundation and as Co-Chair for the American Cancer Society ‘Race for a Cure.’