The Perks of Being Royalty

One of the best things about being the sole owner of a privately held company is that you have a great deal of discretion as to how your business is operated. You get to make the rules. It’s like being the King or Queen.

This includes deciding on the form and content of the financial information your accounting staff prepares. Particularly if you have no debt or outside investors, you can decide what you want to see and how often you want to see it.

The Absolute Basics

Having said that, there are still basic financial statement preparation practices most small business owners follow:

- A meaningful profit and loss statement is usually essential

- A balance sheet is often helpful in monitoring cash and working capital positions

- And most business owners would like to see these statements at least monthly

Since every accounting system generates these reports pretty much automatically, they are relatively easy to produce.

For many small businesses, these are the only two financial statements produced with any regularity.

But Wait, There’s More!

Interestingly, the presentation of financial position under Generally Accepted Accounting Principles (GAAP) requires a total of four (4) statements.

The two statements often ignored are:

- Statement of Changes in Owners’ (or Shareholders’) Equity

- The Statement of Cash Flows.

For many smaller, closely held businesses, the Statement of Changes in Equity is pretty simple, and its omission doesn’t represent an information shortfall.

But its preparation is still a good discipline from an accounting standpoint because it confirms that the retained earnings and owner’s investment accounts roll forward accurately.

What About Cash?

That brings us to the Cash Flow Statement – “The Forgotten Financial Statement.

The three main reasons the Cash Flow Statement is ignored in smaller, closely held businesses are:

- The accountant doesn’t know how to prepare it.

- The owner doesn’t know how to read it.

- It is considered to be of limited value.

In regard to reason #3, instead of a financial statement, many business owners choose instead to focus primarily on their bank account balance to determine if there is a liquidity problem.

They subscribe to the small business adage that “the only thing that matters is how much money you have in the bank."

Yet many business analysts and investors will tell you a company’s ability to consistently generate cash is one of the most important indicators of operational success and business value.

The Cash Flow Statement is the vehicle by which this ability is communicated.

And it is meant to address the one thing virtually all small business owners agree on – it’s all about the cash.

So, What Does It Look Like?

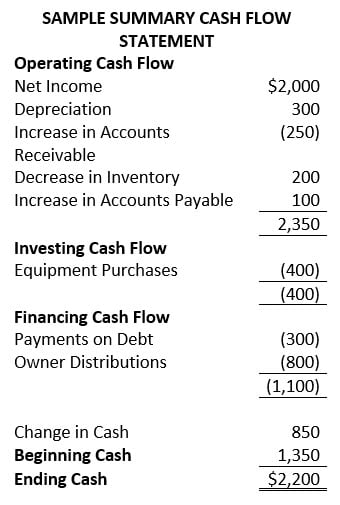

The Cash Flow Statement segregates cash flows into three broad categories:

- Operations: cash received from customers, less cash paid to employees and vendors and cash spent on customer-related assets such as inventory

- Investment: cash spent to purchase equipment as well as business acquisitions, if any

- Financing: cash received from or paid to lenders and investors

At a summary level, a Cash Flow Statement would look something like this:

It can be argued that Operating Cash Flow is perhaps the single most important figure in a set of financial statements.

That’s because it shows how much cash is being generated by the running of the day-to-day business of the company.

Profitable, well-run, established businesses generally have consistently positive Operating Cash Flow.

Unprofitable, poorly run businesses generally do not.

And Now, A Word About EBITDA

Earnings Before Interest Taxes Depreciation and Amortization (“EBITDA”) isn’t a GAAP number. You will rarely see it in a set of audited financials.

But it is considered very important by lenders and potential investors.

Loan covenants often incorporate it. It is also used as the basis for the back of the envelope business valuations.

And in established businesses, there should be a strong correlation between Operating Cash Flow and EBITDA.

Specifically, if EBITDA is positive and Operating Cash Flow is negative, that could be a sign that something is wrong.

The business may be growing rapidly (perhaps too rapidly), and working capital requirements are outpacing revenue growth.

Or certain operating assets, such as accounts receivable or inventory, may be overvalued.

But if EBITDA and Operating Cash Flow are more or less in sync, that’s a good sign.

Other Signs of Trouble

Other red flags may be visible in the Operations section of the Cash Flow Statement.

For example, increases in Accounts Payable show up in the Cash Flow Statement as a “source” of cash.

This may mean that a company is stringing out its vendors – often a very bad sign.

Significant increases in Accounts Receivable will show up as a “use” of cash and can mean collectability problems are on the horizon.

The Cash Flow Crystal Ball

Companies that produce timely, comprehensive Cash Flow Statements are usually better at forecasting future cash flows.

This is because there is always an accurate history of how actual cash flows have been generated that serves as a basis of comparison to validate the credibility of projected future cash flows.

This also allows for ongoing “actual versus budget” comparisons of cash flows as part of the company’s monthly reporting.

Help is on the Way

So, if your closely held business is profitable and growing and you have plenty of money in the bank, maybe you are very comfortable ignoring the Cash Flow Statement.

But if you are having cash flow issues or find yourself unable to forecast future cash performance confidently, you might want to consider incorporating the Cash Flow Statement into your regular reporting (and budgeting).

And if your accountant needs help learning how to prepare it or you might need a bit of help in learning how to read it, there are resources such as the consultants at CFO Selections that will be happy to assist.

About the Author

Dave Saporta has over 30 years of experience in a wide variety of business environments. He has served as CFO and Corporate Controller for large companies with international operations, as well as providing hands-on finance and accounting advisory skills to smaller, emerging businesses.

Dave Saporta has over 30 years of experience in a wide variety of business environments. He has served as CFO and Corporate Controller for large companies with international operations, as well as providing hands-on finance and accounting advisory skills to smaller, emerging businesses.

Dave also has extensive mergers and acquisition experience gained primarily through his four years as a Director of Transaction Services with PricewaterhouseCoopers. Since 2002, Dave has been providing temporary and interim CFO and Controller services to smaller and mid-sized companies, as well as performing contract buy-side due diligence work for private equity firms.