The current economic climate, combined with the fact that September is National Preparedness Month, has many of us thinking about how we can prepare for possible threats and business disruptions. This kind of strategic planning allows a business to approach a worst-case scenario with a growth mindset instead of fear – increasing the likelihood that your business will come out of a crisis stronger for having gone through it.

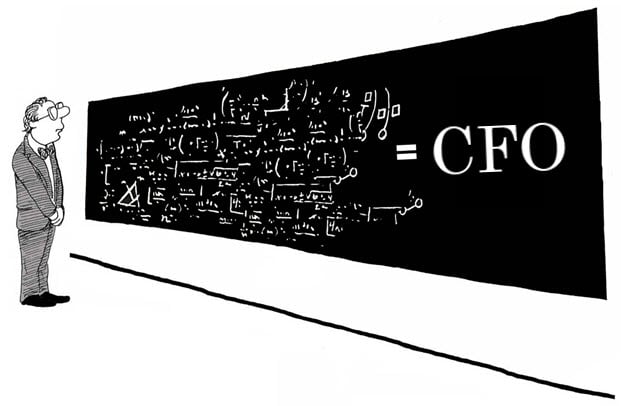

During a worst-case scenario, leadership must decide whether the organization will make the necessary adjustments needed to continue with business as usual or change how the company will operate. And while the conversation will undoubtedly include operational and capacity considerations, it is primarily a discussion about financial capabilities.