A business owner should always have a succession plan, yet at the same time be ready when a member of their executive team is ready to implement their own exit strategy, i.e., retirement. The Great Recession caused many people to need to work longer until retiring because of the loss of income and value of retirement assets. But now, a decade has passed, which has given some the time to replenish their retirement savings. As a result of the COVID19 pandemic many people are re-evaluating what is important to them, and in many instances, it means retiring a few years sooner than originally planned.

In the last few years, we have seen an uptick in the number of accounting leaders retiring while conducting our executive search work for middle-market companies. In addition, some unique demographic issues have occurred in the last 20+ years, making the departure of a long-serving accounting leader for a business owner a more significant challenge than many realize. One of the biggest challenges you will find is how much more expensive it is to hire your next accounting leader. As a business owner, you will need to determine the best way to organize and manage your accounting and finance needs.

Why will it cost more?

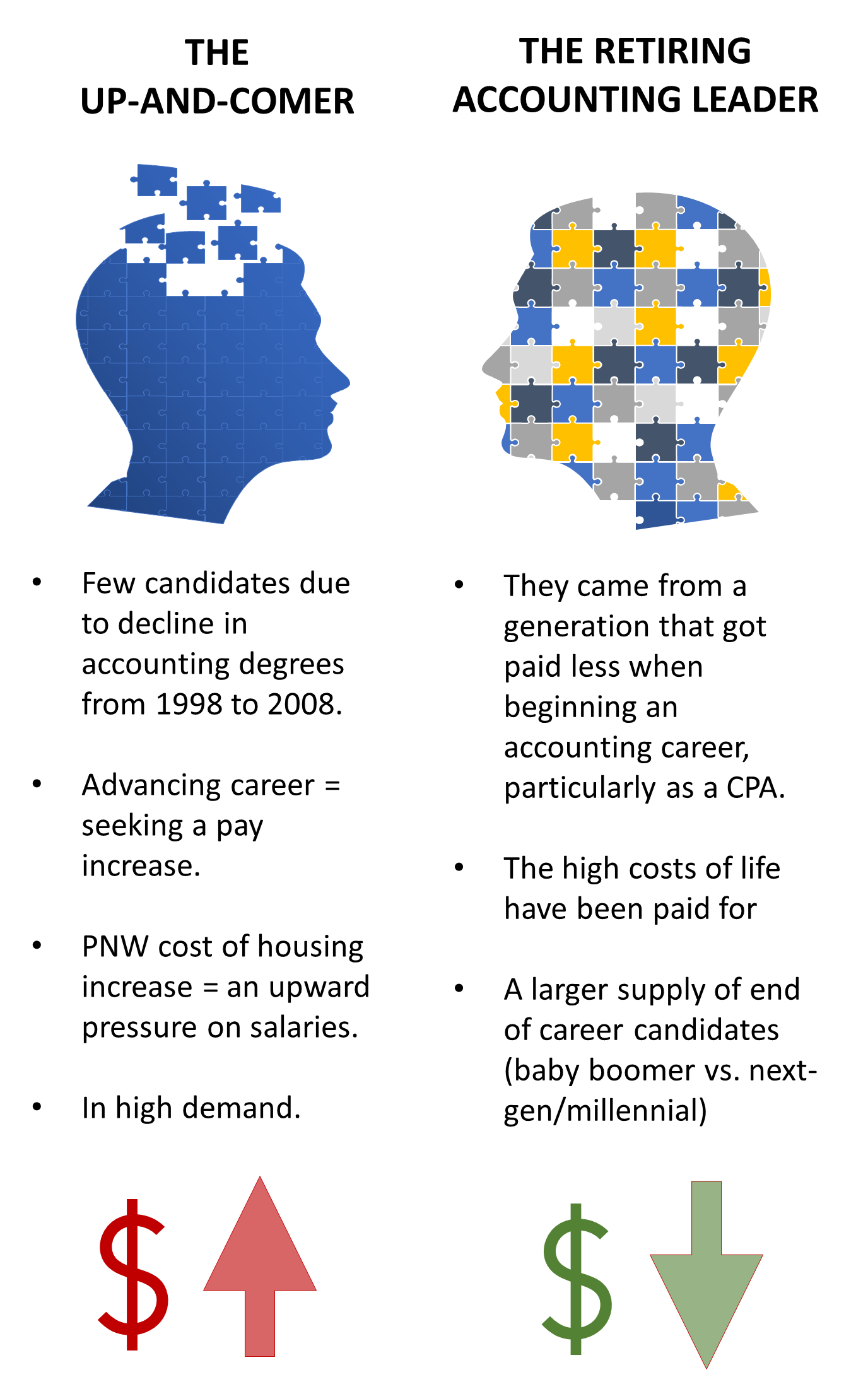

A business owner who had the same accounting leader (CFO or Controller, the title is irrelevant) for more than 10 to 15 years has avoided facing the impact of a shortage of people obtaining an accounting degree. We have previously written about the significant drop from 1998 to 2008 in accounting degrees awarded in the United States.

Today, 20+ years later: When a business owner looks to replace a retiring accounting leader with someone who will hopefully work for the owner (or the owner's next-generation family member) for 15+ years, there are fewer people to choose from in that age range. The basic principle of supply and demand means with high demand and low supply, the cost will be higher. Even though the supply began to improve from 2008 onwards, the demand has outstripped the supply.

The last 25 years have seen a dramatic increase in housing costs in the Pacific Northwest, particularly the greater Puget Sound and Portland/Vancouver WA areas. This has put pressure on wages as people need to earn more to live in this area and build for their future.

From a general personal career management standpoint, as one begins their career, takes on expanded responsibilities, moves up the ranks from a staff accountant or staff auditor to the next rung, an individual expects each move to increase their pay. And thus, in each job move seeks a salary increase. This coincides with life changes, making life more expensive (purchasing a home, possibly having children). Those life changes only get more expensive (bigger home, save for college, providing financial assistance to launching young adult children). This contrasts with someone in the last ten years of their career, where the costs have usually stabilized or even decreased. They also often have peaked in their career from a title and responsibility standpoint – they are an experienced CFO wanting to continue to be a CFO.

This has created two different worlds for you as a business owner. Suppose you want to replace your retiring accounting leader with someone in the first half of their career to provide that next 15+ years of financial advice. In that case, you will pay a lot more in salary and bonus than you likely did for your retiring accounting leader.

What can I do?

The good news is you have options, but you will need to spend some time evaluating your circumstances. It is not just a matter of "I need to hire a new CFO."

Option 1: Pay more

Your business may have grown in size and complexity in that you outgrew your retiring accounting leader anyway. And though it will cost you more, the return on your investment for hiring a new CFO with potentially a broader set of experiences who can help you determine and implement the strategy is worth it. After talking with your banker, your CPA, your peer business owners, or an executive recruiter, you may learn more about your retiring accounting leader. You may have learned they were more of an accountant than an operations-oriented accounting leader. (Read my article "How does your CFO spend their day?") And today, you need that operations-oriented person, and it is worth paying more.

Option 2: Hire a late-stage career accounting leader

As you evaluate your current and medium-term needs, it may be that you don't need the "next 20-year" accounting leader. Maybe a family member has started their career in accounting or finance and could be mentored to be the business's next accounting leader. Maybe you are thinking of selling the business in the next five years. In this case, hiring an accounting leader with 5 to 8 years left in their career may be a better fit for you. As shown in the graphic, the cost could be lower than for a leader in the first half of their career

Option 3: get a part-time accounting leader

The last 20 years have shown how a small to mid-sized business owner no longer needs a full-time CFO/accounting leader. Many of the tasks your retiring accounting leader performed may not be CFO worthy. A way to replace your long-time accounting leader may be to hire a strong, less experienced up and comer generalist accountant and augment them with a fractional CFO or Controller. This part-time CFO can provide mentorship to your new hire and provide you as a business owner with the ongoing business and operations advice you need. The cost of this approach is likely going to be less expensive than hiring a qualified accounting leader who is in the first half of their career. This approach also provides you with flexibility for the future. Your company may grow, and your part-time leader can spend more time as needed, and you don't need to find a new leader. The generalist accountant you have hired can hopefully grow in their career, and eventually, you may have your new leader in that person.

I recently had a conversation with a retiring CFO contemplating their desire to continue to do some work after leaving their company, but not full time. The company was thinking of paying a new accounting leader significantly below market. I suggested the CFO talk with the owners about staying part-time and hiring a lower-level, degreed accountant to match the company's salary range.

Option 4: sell your company

Make it someone else's problem. Of course, this is meant as a joke, but possibly you as a business owner have not focused on your transition plan. Having a long-time trusted CFO retire and leave may be the impetus for you to work on your own transition plan.

Summary

If you are replacing your retiring accounting leader in the Pacific Northwest, you must adjust your salary expectations to reflect regional housing costs, a national shortage of the up-and-comer accounting leaders, and the career level of who is being hired.

Someone in the later stages of their career may be interested in a lateral change in compensation for a more interesting job, but a younger person wants to move up in compensation.

About the Author

Alex de Soto anchors the CFO Selections search practice. He brings over 25 years of experience in accounting, finance, human resources, and executive search to his role as leader of the search team.

Alex de Soto anchors the CFO Selections search practice. He brings over 25 years of experience in accounting, finance, human resources, and executive search to his role as leader of the search team.

Since 2008, he has spent most of his time helping CEO’s and CFO’s of Pacific Northwest based companies find that unique match they seek for a CFO or Controller.