Last year had been dubbed The Year of the Controller by financial recruiters because demand for the position dramatically increased amid uncertain economic times and increased accounting needs at many organizations. This year has seen continued interest in the role and there is no indication that the buzz around the Controller role is slowing down, which means that going into 2024 many companies are still inquiring about how a Controller differs from a CFO (Chief Financial Officer) and how a Controller can benefit their organization.

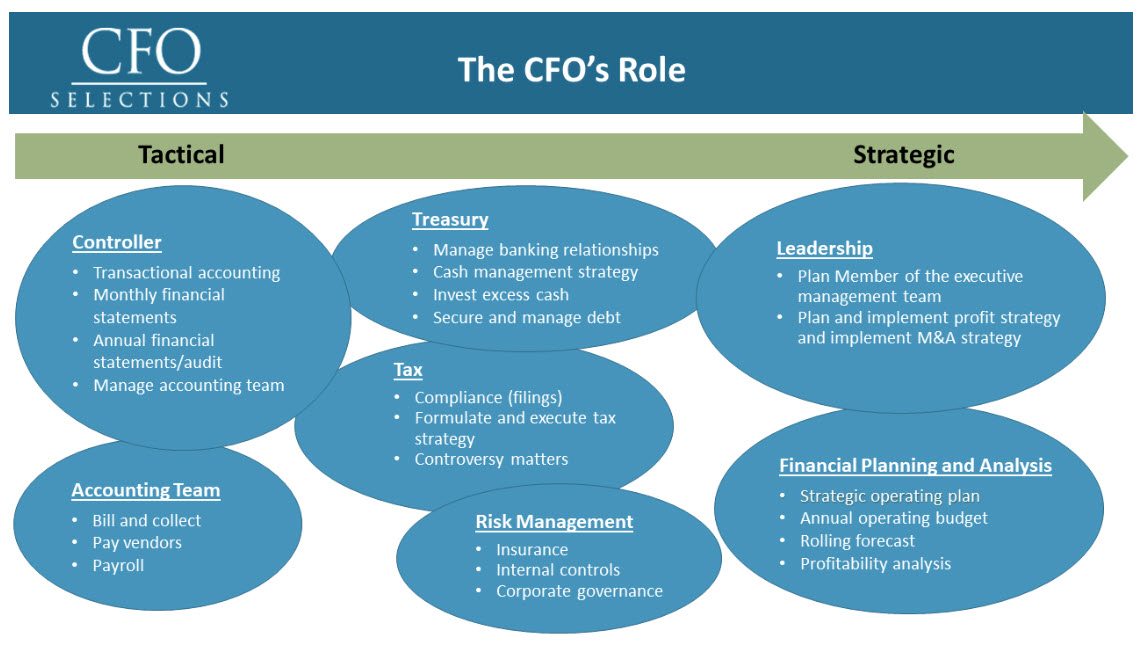

To quickly summarize, a Controller is the head of an accounting department. Controllers oversee financial reports, internal controls, audits, budgets, and financial data. They work with historical accounting information and their role is tactical in nature. The Controller will typically report to the CFO.

CFOs are senior executives that are responsible for the overall financial management of the company – cash flow, risk management, financial planning and analysis (FP&A), and treasury management. Their role is forward-looking and more strategic in nature. The CFO will report directly to the CEO.

While a Controller’s role is distinctly different than a CFO’s role, both are important. A Controller can add significant value to a business in the following ways:

Improve Accounting Processes

One of the areas where Controllers can add the most value is in process improvement. As the most experienced accountant on staff, the Controller can offer financial process and procedure improvement recommendations to help the organization better plan for the future. With a Controller at the helm of the accounting team best practices can be followed to improve areas like budgeting and monthly close.

Establish or Improve Internal Controls

One procedural area where Controllers can have a big impact is on accounting controls. Controllers can implement or strengthen key internal controls to reduce organizational risk. As the old saying goes, “Internal controls keep people out, to keep value in” and the Controller is the chief overseer of these endeavors. This kind of risk mitigation is vital for business growth as well as securing external funding.

Offer Insight

Controllers are highly experienced accountants, which means that they are financial professionals that “have been there before.” As a result, the kind of perspective that they can offer is highly valuable in regard to interpreting the data and communicating its meaning to the rest of the company. Controllers can also support an organization’s existing accounting functions by assessing and improving operations and systems.

Lend Financial Software Expertise

Whether the goal is risk mitigation or revenue growth software will likely play a central role, which means that your accounting team must be adept at using the right kind of technology to get the job done. These days accountants must have significant financial software experience to rise to a leadership level. As a result, Controllers can help their companies find the right software and third-party tools to match business needs, navigating them through the implementation or upgrading process as efficiently as possible to reduce interruption and encourage sustainable growth.

Provide Accurate and Timely Reporting

Reporting is becoming more streamlined every day due to advancements in accounting technology and increased automation possibilities. It is the Controller’s job to use the available tools to prepare accurate, useful, and timely financial reports for senior management and any applicable compliance entities. Correct balance sheets and income statements encourage financial discipline and are required for effective cash flow forecasting to ensure business operations run smoothly. Accurate reporting is the light that illuminates every crevice of the business, including future business modeling activities.

Aid in Business Modeling

When a business plan is created, the Controller will ensure that financial projections and forecasts are developed with timely financial data and the correct assumptions in place. Whether it is for the existing business or new business plans, Controllers will put their expertise to work to do business or product modeling and analyses. This may include project planning and scope work, budgeting and tactical operations estimates, and/or financial model and sensitivity analysis. To ensure that the company is on track with its business plan, the Controller will select the right KPIs (Key Performance Indicators) to use. They will also coordinate with outside vendors like banks, leasing companies, and insurance providers.

Oversee Accounting Personnel

As the head of an accounting department the Controller will have leadership over and provide support around daily accounting activities including credit and collections, AP, AR, payroll, and billing. However, Controllers are not merely concerned with the day-to-day activities of the organization. Controllers also oversee accounting staff development in the form of training, mentoring, and coaching. With the current shortage of accountants, this is a job that simply cannot be overlooked. To win the talent war in accounting today’s organizations must prioritize hiring smarter, onboarding better, continuously supporting, and genuinely valuing the accountants and bookkeepers under them.

When you need controller consulting services, get in touch with our team! We offer interim and fractional controller arrangements to help with running your business and improving your accounting systems until you are ready to hire a controller full-time. Our team of experienced financial leaders can come alongside your organization to provide outsourced controller services, improving cash flow management and strategic planning.